invoice factoring in the Future of a Trucking Business: A Story

Oscar Lewis let the phone ring on his desk. He let his morning coffee cool and left his cigarette to ash itself in the tray, because he is trying to make the biggest decision ever for his transportation company. Lewis transportation Company was at a turning point of growth and Oscar had to decide if signing with a invoice factoring company was the right way forward.

Oscar's father had started as an owner-operator and had grown Lewis transportation Company into a fifteen trailer fleet over forty years. There had been some hard times when it seemed everything was going to go under and even Oscar's mother strapped herself into a cab to make hauls. His father had lived long enough to witness the price of hires drop during the recession and watch the eruption of fuel prices afterwards. Now the company was solely in Oscar's hands and he wanted to live to see it in better shape for his sons.

To move Lewis transportation Company ahead into the future, he needed a steady cash flow but there was just not enough money to go around. His employees needed to be paid. They had families and household bills too. Some of the refrigerated trailers were in need of repairs and he felt to stay competitive it was also a good idea to invest in specialized haulers to be ready for the constant requests he was getting for loads of new energy and agriculture equipment. Every time he had to turn down a request, Lewis transportation looked weak in a very strong market. His father would have told him to wait and to take his time adding on new technology. Oscar allowed himself a good hard chuckle. His father had been against placing GPS units in the cabs. He would say, “Why do you need the voice of some woman to tell you to get off at an exit that has been the same exit that has been there for years?” Also his father had the habit of teasing all the drivers he caught switching into automatic even though driving in automatic was much more efficient though not manly in his father's eyes. His father days were long gone and technology was actually an important improvement for the business such as having Qualcomm to cut down on fruitless time communicating on the phone for bills of lading.

Oscar believed a successful man is always thinking of his next step. What would be the next step for Lewis transportation? And how would he be able to afford it? Funding was all tied up in the mortgage for the office and garage and in the fuel bills. He just finished paying off the small bank loan for installing satellite radio in the trucks for the guys.

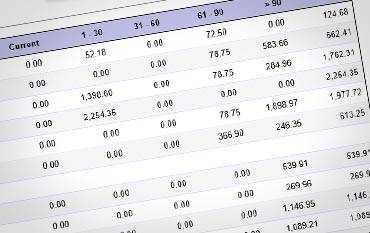

But was invoice factoring the answer? There was a lot he didn't understand about the process. It sounded a lot like ninth grade algebra which just didn't feel like it belonged as part of the transportation business. invoice factoring companies buy your invoices and manage your accounts receivable for a certain percentage of the invoiced amount. The invoice factoring company gives the transportation business its payment right away which allows the business to have continuous cash flow so it can pay employees, buy fuel, and make repairs for upcoming hauls. Without the assistance of invoice factoring, you have to wait for customers to send you the payment which is often 30 days late. In those 30 days, a transportation company can't pay its bills and employees in invoices.

Now it was time for Oscar to do his homework. Oscar had heard that there were companies that charged for same day money transfers and would only advance a percentage of the money owed to your company while holding the rest in a private account if they didn't get their bill payment within 60 or so days. Plus it was worse still if the customer didn't pay up at all because then the invoice factoring company would take it right out of the money supposed to be coming to you! Through the grapevine, he'd also heard about how some companies suddenly slipped you onto a sliding scale of percentages even if you had already signed a lengthy contract for maybe 3% or 7% so there you are with 10% coming as a cost to you out of the freight bill. His friend Ronnie who had a transportation business in Missouri, was run nearly into the ground by a invoice factoring company that charged him the full freight bill on top of the invoice factoring fees. Well, what was the point of going to a invoice factoring company if there was shady business like that going on?

But it turned out to be quite easy. All the invoice factoring companies he researched were open about their business practices and very friendly on the phone when he called. Their customer service actually knew things about their company and spoke in nice clear English so he could understand what was being explained. He didn't mind signing an exclusive contract. He liked the idea of a long term commitment so he knew he wouldn't have to bother going back and forth to different companies and wasting time filing more forms. Nobody charged him for credit checks and they offered him a fuel advance on the pick-up of the load. Many companies offered a non-recourse invoice factoring program that suited him just fine. Also he was happy to hear how much he was offered in terms of percentages on the freight bills. It was good money.

It was really refreshing dealing with the invoice factoring people. They were more personable than those loan managers at the bank. It seemed as though those bank people spoke another language, but these invoice factoring guys knew the transportation business and spoke to him like a client, not like a beggar for a handout. The invoice factoring companies didn't worry over his credit and the debt troubles his father had had in the past of the company. invoice factoring was based on the credit of his customers and on their reliability which worked well for Oscar because he and his father had built up good strong relationships over decades with their list of clients. So he knew they would understand when the invoice factoring company contacted them for the invoices. His clients wouldn't think poorly of Lewis transportation and the invoice factoring companies appeared capable of handling the accounts receivable in the same polite manner that his father had used over the years.

Oscar stepped out of his office to let his secretary know to expect the arrival of the invoice factoring contract shortly. He felt exhilarated by the new possibilities that would make the future of the company fun again and put the stress of the difficult times behind him. With the capabilities of this new cash flow, Oscar could actually expand Lewis transportation Company further across the country and perhaps even go international into Canada. His heart felt full knowing his sons wouldn't have to worry about money because of the right decisions he had made for their transportation business.